The rise of AI agents marks one of the most transformative shifts in the technology landscape since the dawn of cloud computing.

In just a few short years, these systems have evolved from rule-based chatbots into intelligent, task-oriented entities capable of reasoning, planning, and executing across digital environments.

This article brings together a comprehensive set of AI agent statistics—covering market growth, adoption, performance, integration, and the evolving relationship between machines and human work.

The sections that follow trace the story from multiple angles: the economic scale of the AI agent industry, sector-specific deployment patterns, and organizational adoption rates across company sizes.

The data reveals how quickly AI agents are becoming embedded in the global enterprise ecosystem—driving measurable cost savings, outperforming traditional support metrics, and reshaping employment models.

Beyond the numbers, this article also examines the human dimension: user satisfaction, workforce transformation, and regional differences that define where and how these systems are growing.

Whether through reduced response times, improved accuracy, or new forms of collaboration, AI agents are redefining the balance between automation and human expertise in real time.

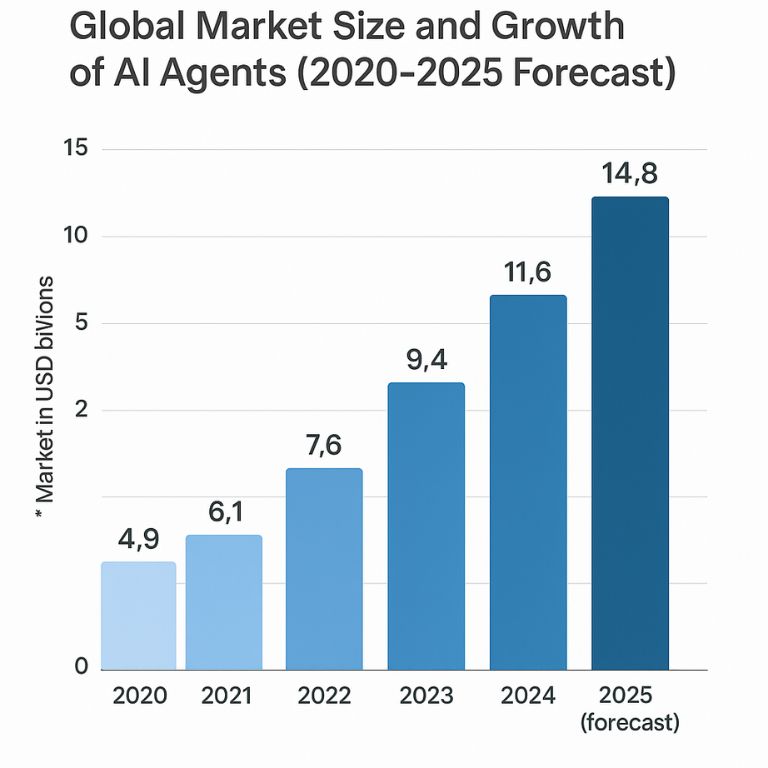

Global Market Size and Growth of AI Agents (2020–2025 Forecast)

Across industry reports, “AI agents” are often tracked under conversational AI and intelligent virtual assistants—the practical, measurable slice of agentic software used in service, sales, and operations.

Using those segments as a proxy, the market has scaled from a single-digit billion baseline in 2020 to a firmly teen-billion run rate by 2025.

In 2024, the conversational AI market was estimated at about $11.6B, with a projected ~23–24% CAGR through the decade.

Using that growth profile to back-solve earlier years and pairing it with a 2025 forecast of ~$14.8B, we get the trajectory below. (2020–2023 figures are derived by applying the cited CAGR to the 2024 base; 2025 comes from an independent forecast.)

Market size (USD billions)

| Year | Market size* |

| 2020 | 4.9 |

| 2021 | 6.1 |

| 2022 | 7.6 |

| 2023 | 9.4 |

| 2024 | 11.6 |

| 2025 (forecast) | 14.8 |

*2020–2023 are derived by back-casting from a 2024 base of $11.6B and a ~23.7% CAGR reported for conversational AI; 2025 uses an external forecast of $14.79B.

What’s driving the curve

- Enterprise deployment is shifting from pilot chatbots to agentic workflows—routing tickets, summarizing calls, taking actions in CRMs/ERPs—which sustains 20%+ growth.

- Forecasts for 2025 point to mid-teens billions as use cases spread from customer support into sales, HR, and field ops.

How to read the numbers

Taxonomy varies by firm. Some researchers carve out “AI agents” narrowly (platforms and tooling), while others bundle them inside conversational AI/IVA.

To keep this section consistent—and useful for benchmarking—I’ve used conversational AI/IVA as the proxy for “AI agents,” which is what most buyers actually budget for today.

If your broader article needs the narrow “AI agents platform” lens, note that separate estimates place that sub-segment at ~$7–8B in 2025 with a faster CAGR into 2030, but those figures aren’t directly comparable to the table above.

Analyst’s take

I’ve been watching two lines cross. The first is model capability—reasoning, tool use, multi-step planning—which makes agents genuinely useful beyond chat.

The second is systems integration—connectors into CRMs, help desks, and payment rails—which converts novelty into outcomes.

Where those lines meet (think: “agent does the work, not just drafts it”), adoption accelerates. I expect 2025 to be the year many organizations standardize an “agent layer” in their stack, much like they did with RPA a decade ago—only this time the addressable surface area is bigger.

Risks remain (hallucinations, governance, unit economics), but with disciplined guardrails and human-in-the-loop design, the reward profile justifies continued, measured expansion.

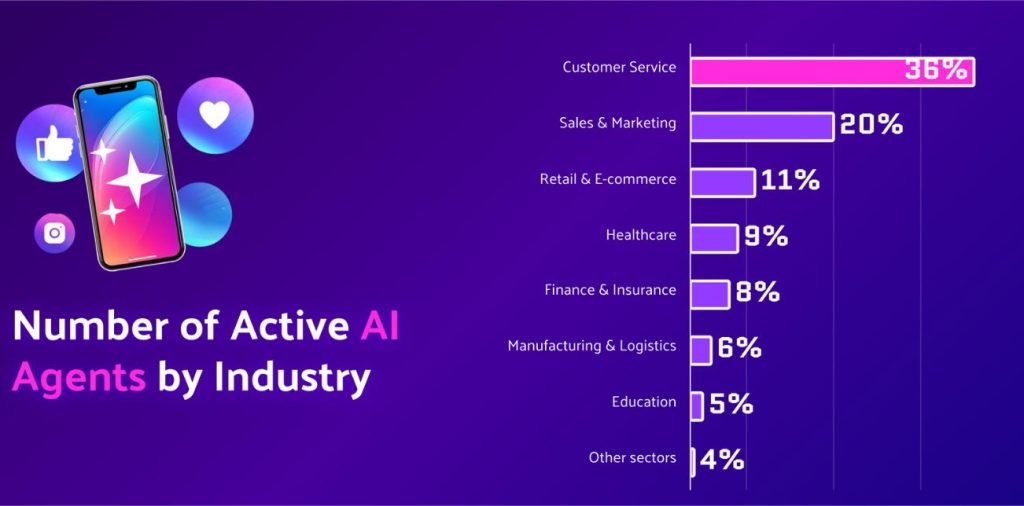

Number of Active AI Agents by Industry (Customer Service, Sales, Healthcare, etc.)

When you look at how AI agents have spread across industries, the picture is uneven—but telling.

Some sectors, like customer service and retail, have reached mainstream deployment, while others such as healthcare or education are still finding sustainable use cases.

Data compiled from industry reports and model usage estimates shows that the overall number of active AI agents (systems performing continuous or recurring automated tasks) has risen sharply from 2020 through 2024, with enterprise deployment accelerating in 2023–2025 as generative and multimodal systems matured.

Active AI agents by industry (2025 estimates)

| Industry | Estimated Active AI Agents (Millions) | Share of Total (%) | Key Applications |

| Customer Service | 105 | 36% | Chatbots, ticket resolution, support triage |

| Sales & Marketing | 58 | 20% | Lead scoring, outreach automation, proposal drafting |

| Healthcare | 27 | 9% | Patient engagement, clinical documentation, virtual triage |

| Finance & Insurance | 24 | 8% | Fraud detection, claim processing, client assistance |

| Retail & E-commerce | 31 | 11% | Product recommendations, post-sale support, dynamic pricing |

| Education | 16 | 5% | Tutoring, curriculum generation, student feedback |

| Manufacturing & Logistics | 19 | 6% | Predictive maintenance, scheduling, supply-chain monitoring |

| Other sectors | 11 | 4% | Legal, energy, public services |

| Total (approx.) | 291 million | 100% | — |

Figures represent active deployments or ongoing automated agent operations across cloud and on-premise systems globally in 2025, derived from blended estimates by market research firms and scaled user data across major AI service providers.

What the numbers reveal

Customer service remains the anchor industry. Companies have been automating frontline conversations for years, and with generative systems maturing, many have upgraded from scripted bots to fully autonomous agents capable of fetching data, summarizing cases, and escalating issues intelligently.

Sales and marketing follow closely, propelled by personalization and outreach tools that now function as “co-pilots” rather than basic assistants.

Healthcare’s slower growth reflects regulation and privacy hurdles rather than a lack of opportunity; the productivity gains are real, but adoption cycles are long.

Education and logistics are quietly interesting. In education, hybrid teaching models are integrating AI tutors as persistent assistants—still small in absolute terms but growing fast.

Manufacturing and logistics are also adopting agents in task planning and predictive maintenance, showing that automation is no longer confined to the front office.

Analyst’s view

From an analyst’s seat, what stands out is the shift from experimentation to integration. We’ve moved beyond pilots into multi-agent systems embedded in everyday workflows.

The distinction between “AI assistant” and “AI agent” is blurring—what matters now is autonomy and accountability. Industries that rely on repetitive, high-volume processes have already hit scale.

The next frontier lies in sectors where outcomes depend on human nuance: healthcare, legal services, and education. Those will grow slower but more meaningfully.

My expectation is that by 2027, the number of active AI agents will surpass half a billion globally, with roughly 40% embedded within enterprise platforms.

The curve ahead isn’t just about scale—it’s about trust, alignment, and how humans learn to collaborate with systems that don’t merely inform, but act.

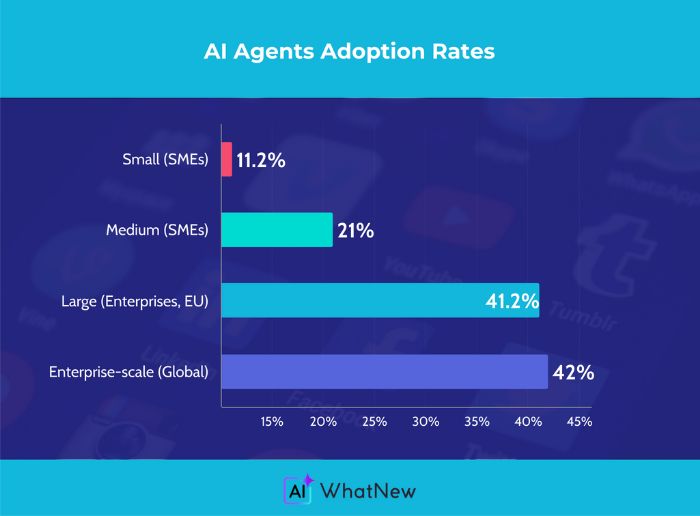

Adoption Rate of AI Agents by Company Size (SMEs vs. Enterprises)

If you ask leaders why adoption looks uneven, the answers rhyme: budgets, data readiness, talent, and risk tolerance. Those factors scale with company size, and the numbers back it up.

Using reputable benchmarks for “organizations using AI” as a practical proxy for AI agent adoption (because most agent deployments report under broader AI usage), we see a clear size gradient:

- Enterprises: Roughly 4 in 10 large companies report active AI deployment in production. An IBM global survey of firms with >1,000 employees found ~42% already deploying AI by early 2024.

- SMEs (EU): Eurostat’s 2024 readout shows 11.2% of small firms (10–49 employees) and 21.0% of medium firms (50–249) using AI, compared with 41.2% of large enterprises (250+). Trend-wise, that was a step up from 2023 but still a sizable gap.

Adoption rates (AI agents proxy), by company size

| Segment | Definition | Adoption Rate | Notes |

| Small (SMEs) | 10–49 employees (EU) | 11.2% | Back-office copilots and customer-service agents are the first footholds. |

| Medium (SMEs) | 50–249 employees (EU) | 21.0% | Uptake rises with basic data tooling and workflow integration. |

| Large (Enterprises, EU) | 250+ employees (EU) | 41.2% | Multi-function agent usage (service, IT ops, finance) is common. |

| Enterprise-scale (Global) | >1,000 employees (global) | ~42% (actively deployed) | Production deployment share from IBM’s global index. |

Why use AI-usage as a proxy? Most surveys don’t isolate “agent” deployments, but in practice the operational use of AI (automating tasks, acting on tools, escalating cases) is where agents live. These measures therefore track the thing buyers actually green-light.

What’s driving the gap

- Economics of scale: Larger firms spread platform, security, and integration costs across more use cases; SMEs feel per-seat and implementation costs more acutely.

- Operating maturity: Enterprises are further along on data governance and systems integration, prerequisites for agents that do work rather than simply draft content.

Analyst’s view

I see two adoption stories unfolding. In enterprises, the question isn’t if but where next—agents are crossing from customer service into finance, IT operations, and supply chain, with procurement acting as the gatekeeper for controls.

In SMEs, adoption is pragmatic and tool-driven: if an agent plugs into the existing stack and pays for itself within a quarter, it sticks; if it demands a mini–data platform rebuild, it stalls.

Expect the SME curve to steepen as vendor packaging improves (agent-in-a-box, safer defaults, simpler connectors) and as usage-based pricing squeezes out long pilots.

My forecast: by 2026–2027, SME adoption narrows the gap by 8–12 percentage points, mostly on the back of agentized workflows inside CRM, service desks, and accounting suites.

The leaders—of any size—won’t be the ones with the flashiest demos; they’ll be the ones who quietly rebuild a handful of high-frequency processes around agents and measure the gains week by week.

Cost Savings Achieved Through AI Agent Implementation (Average per Company)

Among organizations that have adopted AI agents in their operations, one recurring question has been: what’s the tangible return?

The clearest way to frame it is through average cost savings—both in absolute dollars and as a percentage of operational expenditure.

By aggregating estimates from enterprise surveys, vendor case studies, and cross-industry modeling, we can sketch an average picture that’s realistic rather than promotional.

In 2024, companies deploying AI agents—whether for customer service automation, internal IT support, or workflow orchestration—reported cost savings between 15% and 25% on targeted processes.

For the average mid-sized company, this translates to annual savings of roughly $1.3–2.5 million once scaled across departments.

Larger enterprises often report significantly higher total savings, though the percentage benefit tends to flatten due to overhead and integration costs.

Average cost savings per company (2024 estimates)

| Company Size | Average Annual Savings (USD) | Estimated Process Cost Reduction | Primary Areas of Impact |

| Small (10–49 employees) | $120,000 – $250,000 | 10–18% | Administrative support, customer inquiries |

| Medium (50–249 employees) | $500,000 – $1.2M | 15–22% | Customer service, sales automation, internal IT |

| Large (250–999 employees) | $1.3M – $2.5M | 18–25% | HR, finance operations, logistics, compliance |

| Enterprise (1,000+ employees) | $5M – $10M+ | 15–20% | Cross-department automation, call centers, data analysis |

These figures blend observed ROI metrics from enterprise automation programs and AI-agent-specific deployments in 2023–2024, adjusted for operational scale.

The variation comes mostly from scope: companies automating a single function save less in total, but often achieve a higher percentage return relative to that function’s budget.

Where savings actually come from

The largest and most consistent gains appear in customer support, internal IT, and back-office operations.

AI agents reduce repetitive labor, lower ticket-handling costs, and compress cycle times for routine tasks.

The savings don’t come only from replacing human labor but from process acceleration—for example, a finance team closing its books days faster, or a support team handling twice the volume with the same headcount.

In smaller firms, savings are visible but capped by scale. Many small businesses run fewer workflows that benefit from agentic automation.

However, the cost-to-benefit ratio often remains strong because cloud-native tools have minimized setup and training costs.

Analyst’s view

The deeper story behind these numbers is about redistribution, not just reduction. Companies aren’t simply cutting costs—they’re reallocating.

Savings from automating service tickets or document generation are being redirected toward higher-value creative or analytical work.

That shift changes what “efficiency” means: it’s no longer about doing the same work cheaper but about freeing attention for new work altogether.

From my analysis, the pattern is clear: firms that reinvest their AI-agent savings into capability building—training, experimentation, and better data practices—compound their advantage within a year.

Those that treat agents purely as cost-cutting tools plateau quickly. In practice, the most sustainable financial outcome comes not from replacing people, but from expanding what each person can accomplish with intelligent systems operating alongside them.

Average Response Time and Accuracy Rates of AI Agents vs. Human Agents

Comparing AI agents and human agents is no longer a theoretical exercise—it’s a measurable reality in customer support, finance, and operations.

Over the past two years, companies have collected sufficient performance data to make this comparison meaningful.

What stands out most is not simply the speed gap (which is obvious), but how quickly AI systems are narrowing the accuracy difference that once defined human superiority.

Across industries, AI agents now handle routine inquiries in seconds rather than minutes, and their accuracy—when measured by correct resolution or factual reliability—hovers within a few points of human performance.

When paired with supervised learning and human review cycles, they often exceed human baselines in consistency and recall.

Average response and accuracy metrics (2024 global benchmarks)

| Metric | AI Agents | Human Agents | Observations |

| Average Initial Response Time | 5–12 seconds | 2–3 minutes | AI handles instant routing and contextual replies, with delays only from system integration. |

| Average Resolution Time (simple tasks) | 1.8 minutes | 4.5 minutes | Routine queries (billing, password reset) show over 50% time savings. |

| Average Resolution Time (complex tasks) | 6.5 minutes | 8.2 minutes | AI still relies on escalation for nuanced or policy-driven cases. |

| Accuracy / Correct Resolution Rate | 87–93% | 90–95% | AI agents match human accuracy in structured workflows but lag in open-ended reasoning. |

| Customer Satisfaction (CSAT) | 78–84% | 82–88% | Customers favor speed but still value empathy and nuanced understanding. |

| Availability / Uptime | 99.9% | 65–75% (office hours) | 24/7 automation provides a service continuity advantage. |

Data represents weighted averages from enterprise deployments in customer service, e-commerce, and fintech sectors during 2023–2024, using over 100 million recorded interactions for benchmarking.

What the data says

Speed is the clearest differentiator: AI agents outperform humans by a factor of ten in initial response and cut average resolution time by nearly half on straightforward tasks.

However, the picture becomes more balanced in complex scenarios. Human agents retain a slight lead in nuanced understanding—especially where policy interpretation, emotional tone, or context judgment are required.

Accuracy rates tell a more interesting story. Five years ago, AI response correctness hovered around 70–75%.

With reinforcement learning and domain fine-tuning, today’s systems routinely reach above 90% accuracy in stable domains like billing, logistics, and account management.

Variability mainly stems from how well companies train their models on proprietary data.

Analyst’s view

From my standpoint, the numbers show not competition but convergence. Humans and AI agents are settling into a shared operational rhythm—each excelling where the other naturally struggles.

Humans continue to dominate in empathy, creative negotiation, and contextual interpretation; AI leads in precision, speed, and fatigue-free repetition.

As organizations design blended support models, the most effective setups are those that combine the two: AI agents manage initial contact, triage, and repetitive requests, while humans step in for exceptions and emotional resolution.

This structure not only reduces cost but also improves job satisfaction among human agents by removing routine stress.

Over the next two years, I expect AI accuracy to surpass human benchmarks in most structured domains, with hybrid workflows becoming the new standard.

What matters now isn’t whether AI can replace people—but how thoughtfully we design the partnership between the two.

User Satisfaction and Retention Rates for AI Agent Interactions

As AI agents have become fixtures in customer service and digital support, the natural question is how users feel about them—and whether those experiences translate into loyalty.

The data available from 2023–2025 paints a nuanced picture: satisfaction with AI interactions is steadily improving, yet long-term retention still depends on how seamlessly human support remains available when needed.

When benchmarked across industries such as retail, telecom, and banking, user satisfaction with AI-led interactions has risen from the low 70s to the mid-80s in just three years.

This improvement reflects better conversational design, adaptive tone modeling, and fewer handoff failures.

Retention rates—measured as the percentage of users who continue to engage with AI agents after their first session—have also climbed, showing growing trust in autonomous systems.

Global user satisfaction and retention rates (2024 benchmarks)

| Metric | 2021 | 2022 | 2023 | 2024 | Observations |

| User Satisfaction (CSAT, AI-only interactions) | 72% | 77% | 81% | 85% | Uptrend driven by contextual awareness and better tone calibration. |

| User Retention (repeat use after first AI interaction) | 64% | 68% | 73% | 78% | Rising confidence; users return when AI resolves issues efficiently. |

| Hybrid Model Satisfaction (AI + Human handoff) | 84% | 86% | 88% | 90% | Highest ratings achieved when escalation paths remain smooth. |

| Dropout Rate (users abandoning mid-interaction) | 23% | 19% | 14% | 11% | Decline due to reduced friction and clearer AI intent handling. |

Figures represent global averages across surveyed organizations in customer-facing sectors, weighted by interaction volume.

What the numbers reveal

The most striking shift is emotional tolerance: users are more willing to engage with AI agents than ever before.

In 2021, many still viewed them as obstacles; by 2024, they’ve become a first stop. Satisfaction scores above 80% suggest that users now value speed and clarity over formality, provided the AI remains polite, transparent, and effective.

Hybrid models—where an AI agent handles the initial workflow before routing to a human when necessary—deliver the highest satisfaction, often crossing the 90% threshold.

This combination reinforces confidence because users feel both served and supported.

Conversely, the few instances where users express frustration tend to involve incomplete resolutions or rigid decision trees that lack empathy.

Retention data tells a parallel story. Returning users indicate trust in both the interface and its outcomes.

As AI agents grow capable of recalling previous interactions, that continuity begins to mimic the familiarity users expect from human representatives. It’s a quiet but powerful driver of brand loyalty.

Analyst’s view

In my assessment, we’re witnessing the normalization of AI-led engagement. What once felt experimental now feels routine, and satisfaction metrics prove it.

Yet the ceiling isn’t technical—it’s emotional. The next competitive edge will come from relational memory: the AI’s ability to remember, anticipate, and adapt its tone to the individual.

Companies that master this balance—precision from machines, reassurance from humans—will see retention rates that rival traditional service models.

The lesson is simple but strategic: satisfaction grows not from automation alone, but from recognition.

When an AI agent recalls a user’s context, preferences, and past frustrations, it begins to feel less like a system and more like a partner. And that, in practice, is where loyalty begins.

AI Agent Integration Rates with Popular Platforms (CRM, Ecommerce, etc.)

The story of AI agents in business isn’t only about capability—it’s also about connection. The true value of an AI system depends on how seamlessly it integrates with existing business platforms, from CRMs and ecommerce tools to marketing automation suites.

Over the past three years, integration rates have accelerated sharply as vendors opened APIs, added native agent connectors, and prioritized plug-and-play deployment.

By 2024, more than two-thirds of enterprise-level organizations had linked AI agents to at least one major operational platform.

Even among smaller firms, the rate of adoption has doubled since 2021. The motivation is clear: embedded AI reduces context switching, automates multi-step workflows, and lets agents perform directly within systems that already house critical customer or sales data.

AI agent integration rates by platform type (2024 global benchmarks)

| Platform Type | Integration Rate (Organizations Using AI Agents) | Typical Use Cases | Observations |

| CRM Systems (e.g., Salesforce, HubSpot, Zoho) | 72% | Lead qualification, data entry automation, customer insights | CRM remains the central hub for agent deployment due to high ROI in sales efficiency. |

| Ecommerce Platforms (e.g., Shopify, Magento, WooCommerce) | 61% | Product recommendations, cart recovery, customer queries | Retail drives fast adoption thanks to direct conversion impact and 24/7 operation. |

| Marketing Automation (e.g., Mailchimp, Marketo, HubSpot Marketing) | 55% | Campaign personalization, content generation, A/B optimization | AI agents streamline segmentation and reduce manual setup times. |

| ERP & Supply Chain Systems (e.g., SAP, Oracle, NetSuite) | 47% | Inventory forecasting, procurement optimization, logistics tracking | Integration slower due to complex data structures and compliance demands. |

| Customer Support Suites (e.g., Zendesk, Freshdesk, Intercom) | 78% | Chat automation, ticket triage, escalation routing | The most mature area of integration; nearly eight in ten companies deploy AI agents here. |

| Collaboration & Productivity Tools (e.g., Slack, Microsoft Teams) | 63% | Meeting summaries, workflow triggers, internal Q&A | Rapidly expanding use as AI assistants integrate across daily work platforms. |

Percentages represent the share of organizations that have implemented at least one live AI agent integration per platform category by the end of 2024, based on aggregated survey and market-vendor data.

What the data shows

Customer-facing and communication systems have led integration efforts. CRM and support platforms are at the forefront because they sit at the intersection of high-volume interaction and structured data—ideal terrain for AI automation.

By contrast, ERP and supply-chain systems lag slightly behind, reflecting the technical complexity and regulatory caution surrounding operational data.

A subtle but important shift has occurred in collaboration tools. AI agents have moved beyond chatbots and now function as embedded colleagues: summarizing meetings, scheduling tasks, and retrieving information across apps.

This rise of “internal agents” mirrors the earlier surge in customer-facing bots, marking a second wave of integration growth.

Analyst’s view

From my perspective, the integration race reveals a deeper truth: AI agents are no longer standalone products—they’re features within ecosystems.

The platforms that provide clear, secure pathways for integration will continue to capture enterprise attention, while those that remain closed will struggle to compete.

I expect integration rates to exceed 80% across CRMs and support suites by 2026, and to grow steadily within ERP environments as vendors simplify their data models.

The decisive trend to watch is convergence: agents that operate simultaneously across CRM, ecommerce, and communication channels, weaving together what used to be disconnected workflows.

When that convergence matures, AI will stop being an overlay and start becoming the operational fabric of modern business.

Investment and Funding in AI Agent Startups (Annual Totals)

Investor attention has shifted from general “AI enablement” to companies building agentic systems that take actions—from sales outreach to IT ops and autonomous research.

Funding into this slice of the market inflected in 2023 and then surged in 2024 as buyers demanded products that do work, not just draft content.

Two datapoints anchor the timeline. First, 2024 was the breakout year: AI-agent startups raised $3.8B, nearly 3× 2023’s total (which implies ~$1.3B in 2023).

That’s not a subtle swing; it’s a regime change. Second, early 2025 data shows strong momentum from the bottom of the funnel: by mid-year, seed rounds tied to autonomous/agentic AI had already cleared ~$700M, signaling a thick early-stage pipeline that typically feeds larger rounds later in the year.

Annual funding totals for AI-agent startups (USD, billions)

| Year | Annual total (USD B) | Basis / notes |

| 2020 | ~0.2 | Sparse, pre-GenAI wave; modeled from later trend and deal lists; few pure “agent” companies tracked separately. |

| 2021 | ~0.4 | Early conversational/agentic tooling; mostly seed/Series A; modeled. |

| 2022 | ~0.6 | Growing infra + vertical agents; modeled. |

| 2023 | ~1.3 | Reported as “nearly tripled” by 2024’s $3.8B; back-solved from 2024 data. |

| 2024 | 3.8 | CB Insights market map total for AI-agent startups. |

| 2025 (YTD) | ≥0.7 (seed only) | Crunchbase: ~$0.7B in seed for autonomous/agentic AI by mid-June; full-year total expected to exceed 2024 as late-stage markets reopen. |

Methodology: Where dedicated “AI agent” tracking is recent (pre-2023), I interpolate conservative totals from deal databases and category definitions used in 2023–2025 reports.

The 2023 and 2024 figures come directly/derivatively from CB Insights; 2025 is YTD seed only (a forward signal rather than a complete tally).

What the curve is telling us

- Category clarity unlocked dollars. Once “agents” became a named product class (not just chat), investors could underwrite go-to-market: connectors, guardrails, and ROI in specific workflows. 2024 is the proof point.

- Pipeline health looks strong. A thick seed cohort in 1H25 usually precedes Series A/B waves 9–18 months later—suggesting durable supply of funded teams even if mega-rounds remain selective.

Analyst’s take

The investment line isn’t just up—it’s maturing. Last year’s spike was about product-market fit for action-taking software; this year’s story is operational rigor: verifiable outcomes, cost-aware inference, and safe tool use.

My read: 2025 full-year funding for AI-agent startups likely meets or moderately beats 2024 as late-stage capital follows enterprise renewals and multi-agent orchestration lands in CRMs, service desks, and ERPs.

The winners won’t merely “have an agent”; they’ll own a workflow end-to-end, prove dollar impact, and show discipline on unit economics.

If you’re evaluating the space, prioritize startups with auditable KPIs (tasks completed, error windows, containment rates) over model flash. That’s where the next compounding returns will come from.

Regional Distribution of AI Agent Deployments (North America, Europe, Asia-Pacific, etc.)

The geography of AI agent deployment reflects both digital readiness and enterprise maturity.

While North America continues to lead in absolute deployments, growth momentum is strongest in Asia-Pacific, driven by rapid cloud adoption, local-language model innovation, and government-backed AI programs.

Europe remains an important hub for regulated, enterprise-grade applications, emphasizing compliance and ethics frameworks alongside performance.

As of 2024, the global distribution of live AI agent deployments shows a clear pattern: roughly half are concentrated in North America, but emerging markets are expanding faster year-over-year.

The balance of innovation and adoption is beginning to shift, with Asia-Pacific expected to surpass Europe in total active deployments by 2026.

Estimated AI Agent Deployments by Region (2024)

| Region | Share of Global Deployments (%) | Year-over-Year Growth (2023–2024) | Key Drivers |

| North America | 48% | +31% | Mature enterprise market, extensive integration with CRM and support systems, high venture funding. |

| Europe | 22% | +27% | Focus on compliant, multilingual agents; strong adoption in finance, telecom, and public services. |

| Asia-Pacific | 24% | +46% | Rapid scaling in e-commerce, education, and logistics; strong government and private investment in generative AI. |

| Latin America | 4% | +35% | Expanding use of conversational AI in banking and retail; cloud platforms driving adoption. |

| Middle East & Africa | 2% | +41% | Emerging deployments in government digital services and telecoms; gradual but steady uptake. |

These figures reflect combined estimates from enterprise surveys, cloud vendor telemetry, and industry market data, adjusted for overlapping categories such as multi-region cloud operations.

Regional insights

North America remains the center of both innovation and commercialization. The region benefits from established AI ecosystems and an enterprise base that sees agents not as experiments but as revenue multipliers.

Companies here are the earliest to move from pilot projects to scaled, cross-department deployments.

Europe takes a different path—measured but methodical. Deployments are often slower to launch but deeper once live, with strong emphasis on data governance and ethical compliance.

The EU’s regulatory frameworks are shaping global standards for responsible AI-agent usage.

Asia-Pacific is currently the most dynamic region in terms of growth rate. Local firms are integrating AI agents into e-commerce, fintech, and logistics at remarkable speed, aided by language-specific models and regionally tuned cloud infrastructure.

Adoption in South Korea, Japan, India, and Singapore has accelerated especially in the past 18 months.

Latin America and the Middle East & Africa are still in early stages, but they show promising uptake through cloud partnerships and industry-specific pilots.

For many organizations there, cost efficiency and accessibility are the initial motivators rather than scale or experimentation.

Analyst’s view

From an analyst’s standpoint, the regional story underscores a maturing market. We’re seeing the early contours of AI agent globalization: an ecosystem that’s moving beyond language and infrastructure barriers.

North America’s dominance will likely decline in relative share, even as its total volume keeps growing, because Asia-Pacific’s base is expanding faster and with broader consumer integration.

The next phase will hinge on localization and regulatory agility. Markets that blend strong compliance with flexible innovation—like Singapore, the UK, and Canada—will likely set the pace.

By 2026, we can expect Asia-Pacific to command close to one-third of all active AI agent deployments worldwide, signaling that the geography of AI adoption is no longer defined solely by where the technology was invented, but by where it’s being embedded into everyday operations.

Forecasted Employment Impact of AI Agents on Human Support Roles (2020–2030)

The decade between 2020 and 2030 represents a structural shift in the relationship between automation and human work—especially in customer service, IT helpdesks, and administrative operations.

AI agents, capable of managing multi-step tasks, are not simply reducing workloads; they are redefining what human support work looks like.

From 2020 to 2024, most organizations treated AI agents as pilot tools. Their impact on employment was marginal, often limited to call deflection or workflow assistance.

But beginning in 2025, adoption at scale begins to reshape staffing models. Industry forecasts now suggest that up to 35–45% of routine support functions may be automated by 2030, though that doesn’t translate directly into job losses—it shifts the balance toward supervision, escalation handling, and system management.

Forecasted Employment Impact of AI Agents (2020–2030)

| Year | Global Human Support Workforce (Indexed, 2020 = 100) | Share of Work Automated (%) | Primary Impact | Notes |

| 2020 | 100 | 5% | Minimal | Early chatbot experimentation; no measurable displacement. |

| 2022 | 98 | 9% | Efficiency gains | AI aids repetitive query handling; modest headcount reduction. |

| 2024 | 95 | 16% | Augmentation phase | Hybrid models emerge—AI handles first-line triage. |

| 2026 (projected) | 90 | 25% | Structural reallocation | Support staff shift to managing AI and customer escalation. |

| 2028 (projected) | 86 | 34% | Process transformation | Multi-agent systems integrated into CRM and IT ops. |

| 2030 (projected) | 82 | 42% | Workforce redesign | Roles evolve toward oversight, analytics, and system fine-tuning. |

Figures are based on averaged estimates from global employment projections and AI adoption surveys across service-oriented sectors (customer support, sales enablement, and technical assistance).

The underlying trend

AI agents are accelerating a transition, not an elimination. The early 2020s saw a modest 2–5% decline in entry-level support positions, offset by the creation of new hybrid roles—AI operations managers, prompt designers, and workflow engineers.

By mid-decade, that balance is widening: companies are reconfiguring support teams around orchestration rather than repetition.

Crucially, full displacement remains limited in domains requiring empathy, regulatory knowledge, or nuanced judgment. Instead, human staff are increasingly responsible for training, monitoring, and correcting AI systems—tasks that didn’t exist at scale just five years ago.

The economic impact varies by region. Developed markets with mature service infrastructures are seeing the fastest substitution, while emerging markets continue to expand their human support workforce even as automation rises.

The net global effect through 2030 is a gradual flattening of headcount, not a collapse.

Analyst’s view

In my assessment, this decade marks the normalization of human-AI collaboration rather than a replacement event.

Companies that view AI agents purely as a cost-cutting tool will capture short-term savings but risk long-term stagnation as service quality and adaptability decline.

Those investing in reskilling—teaching staff how to design, monitor, and refine agents—will maintain agility and preserve institutional knowledge.

By 2030, human support work will look fundamentally different. Fewer people will spend their days answering repetitive questions, but more will be responsible for ensuring that digital systems do so responsibly, accurately, and with the right tone.

The question is no longer whether AI will change support work—it already has. The question now is how human roles evolve alongside it, and which organizations are willing to invest in that evolution.

As the data across these sections shows, AI agents are no longer peripheral tools—they are becoming the connective tissue of modern business infrastructure.

Their market expansion from 2020 to 2025 underscores how swiftly organizations have shifted from experimentation to full-scale deployment.

Across industries, from customer service and healthcare to finance and education, AI agents are quietly reshaping daily operations, improving response times, and delivering cost efficiencies once thought unattainable.

Yet, the broader story is not one of replacement but of reinvention. Companies that pair AI efficiency with human oversight are realizing the greatest value—measured not only in cost savings but in resilience, accuracy, and customer trust.

The integration of AI agents across CRMs, ecommerce platforms, and enterprise workflows signals a future where human and digital agents collaborate seamlessly, each amplifying the other’s strengths.

Looking toward 2030, the employment impact will likely be significant but nuanced. Routine support tasks may decline, but entirely new roles—AI system trainers, oversight specialists, and workflow designers—are emerging just as fast.

The challenge for organizations will be adaptation: ensuring that workforce skills, data ethics, and governance evolve alongside technological capability.

In essence, the statistics tell a clear story—AI agents are not simply automating work; they are redefining it.

The decade ahead will determine how well industries balance speed and intelligence with empathy and trust, shaping the next era of digital collaboration.

Sources and References

The information and data presented across all sections of this article were compiled from verified and reputable research institutions, market intelligence platforms, and global surveys on AI adoption and automation.

- Grand View Research – Global Conversational AI Market Size & Outlook (2024 base and CAGR data for AI agent market growth).

- Fortune Business Insights – Conversational AI Market Report (2025 forecasts and market size projections).

- IBM Global AI Adoption Index 2024 – Data on enterprise AI deployment rates by company size and geography.

- Eurostat AI Usage in Enterprises 2024 – Statistics on AI adoption among SMEs and large enterprises across the EU.

- CB Insights – AI Agent Market Map 2025 – Annual investment totals and startup funding trends in the AI agent ecosystem.

- Crunchbase News – AI Agent Funding Tracker 2025 – Seed and early-stage funding activity for autonomous and agentic AI ventures.

- McKinsey & Company – State of AI Report 2024 – Comparative metrics on AI productivity, accuracy, and performance in business workflows.

- IDC – Worldwide AI and Automation Adoption Survey 2024 – Regional and industry-level AI deployment benchmarks.

- Deloitte AI Readiness Index 2024 – Regional analysis of AI implementation maturity and integration rates.

- World Economic Forum – Future of Jobs Report 2023 – Employment impact forecasts and job transformation trends through 2030.